[Source: California Center for Jobs and the Economy] The latest new vehicle sales data from California New Car Dealers Association shows that, as expected, the above-trend ZEV sales in Q4 2017 were likely consumer responses to the potential sunset of related federal subsidies. The Q1 sales of true ZEVs (battery and fuel cell vehicles) were slightly below the quarterly levels from a year prior. Total PEV sales (plug-in hybrids and ZEVs) were up solely as a result of continued shifts from hybrid to plug-in hybrid sales, likely reflecting continued consumer acceptance issues related to range, higher purchase price, and reliability of the new technologies.

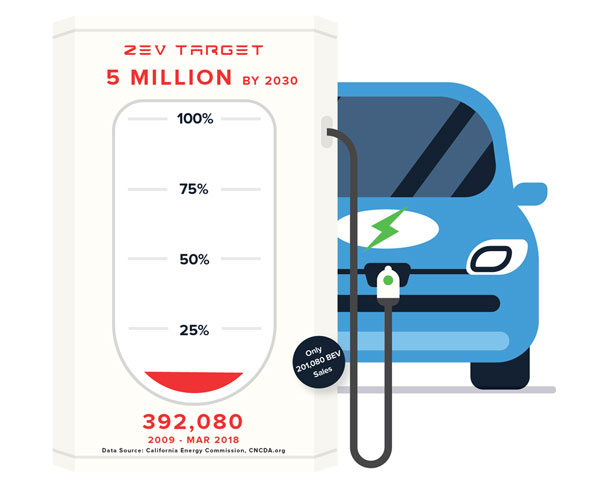

Cumulative PEV Sales at 7.8% of 2030 Goal True ZEVs at 4.0%

As part of the AB 32 climate change program, Executive Order B-48-18 administratively created a goal of 5 million zero-emission vehicles (ZEVs) on California roads by 2030. This action expands on the prior Executive Order B-16-2012, which set a goal of 1.5 million by 2025, with a sub-goal that their market share is expanding at that point.

Rather than only true ZEVs, the numbers in the Executive Order and previous interpretations by the agencies indicate the goal is to be achieved by both ZEVs (battery electric vehicles (BEV)) that run only on electricity and plug-in hybrids (PHEV) which run on both electricity and motor fuels. Consequently, only a portion of the vehicles being counted to meet the zero emission goal—roughly half based on current sales volumes—will in fact produce zero emissions. Additionally, FCEVs (fuel cell electric vehicles) also would count towards the ZEV total, but CNCDA show total market share for these vehicles at only 0.1%.

Using this broader interpretation, total PEV sales since 2009 account for 7.8% of the 2030 goal. True ZEV sales (BEVs), however, account for only 4.0%.

Manufacturing Job Provisions of Executive Order B-16-2012 Still Not Implemented

The state’s current energy costs, additional labor law restrictions and litigation risks, and lengthy permitting processes continue to limit the ZEV related manufacturers choosing to locate within California. Rather than tackle these well-documented barriers to new manufacturing jobs, the most recent version of the Zev Action Plan instead calls primarily for data collection and conversations:

“Moving forward, state government will play a central role connecting regions to share best practices, gathering economic data to measure ZEV market growth and ensuring our workforce is trained to meet future needs.”